What Is Medicare Advantage Open Enrollment? And Why You Should Call Suzie Before You Regret It

Ah, the new year. A time for resolutions you may or may not keep, gym memberships that go unused after January 15th, and… Medicare Advantage Open Enrollment! That’s right, folks. While the world is busy pretending kale smoothies are delicious, you’ve got the golden opportunity to switch, drop, or tweak your Medicare Advantage plan from January 1st to March 31st.

So, what exactly is Medicare Advantage Open Enrollment? Don’t worry, we’re here to make it crystal clear, with fewer big words and more laughs. And if it still feels like a brain bender? That’s when you call Wenatchee Insurance and let Suzie save the day.

The Open Enrollment Lowdown

Imagine you bought a car, but by January you realize it’s more of a lemon than a luxury ride. Maybe it gets terrible mileage. Maybe the stereo only plays polka music. Either way, you need a switch. Well, Medicare Advantage Open Enrollment is your chance to ditch the “lemon” plan and grab something that fits your life—minus the accordion solos.

During this special window:

You can switch to a different Medicare Advantage plan (because sometimes you just need a better deal).

You can drop your Medicare Advantage plan and go back to Original Medicare (hello, freedom!).

You can add a Medicare Part D plan for prescriptions (because paying full price for meds isn’t on anyone’s vision board).

It’s a relaunch for this year’s health insurance. But here’s the kicker: you can only make ONE change during this window. That’s right—no double-dipping. So, we have to make it count!

Why You Need Suzie From Wenatchee Insurance (Like, Yesterday)

Here’s the deal: Medicare rules can feel more confusing than assembling furniture with no instructions. One minute you’re comparing plans, and the next you’re buried in pamphlets muttering, “What even is a deductible?” It’s a slippery slope, my friend.

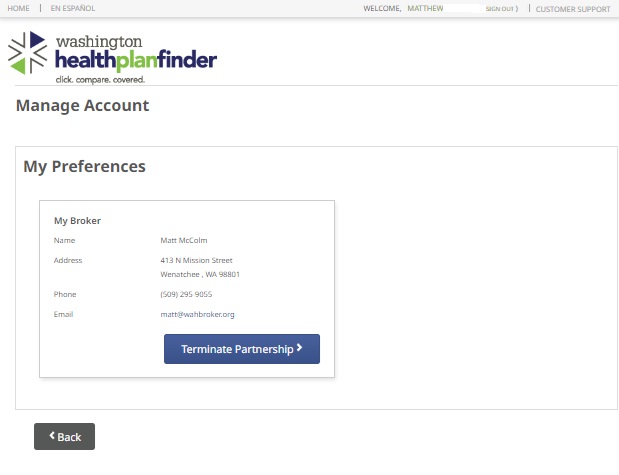

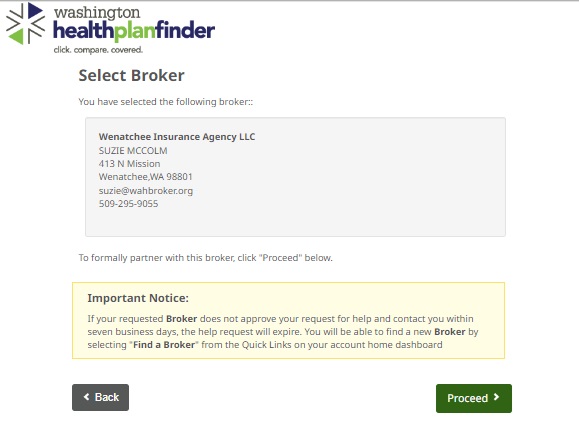

Enter Suzie. She’s not just any insurance agent; she’s the Medicare whisperer of Wenatchee Insurance. Picture this: while you’re sipping coffee and trying to remember what Part C does, Suzie’s already found three plans that cover your favorite doctors, lower your out-of-pocket costs, and include extra perks like dental or vision. She’s like a superhero, but instead of a cape, she wears a friendly smile and has a phone glued to her hand.

Need examples? Let’s say you’re Steve from East Wenatchee. Steve didn’t call Suzie last year and ended up with a plan that didn’t cover his prescriptions—ouch. Meanwhile, Betty from Cashmere gave Suzie a ring, and now her plan includes gym memberships and a dental cleaning so good her dentist asked for her secret.

Don’t be a Steve. Be a Betty.

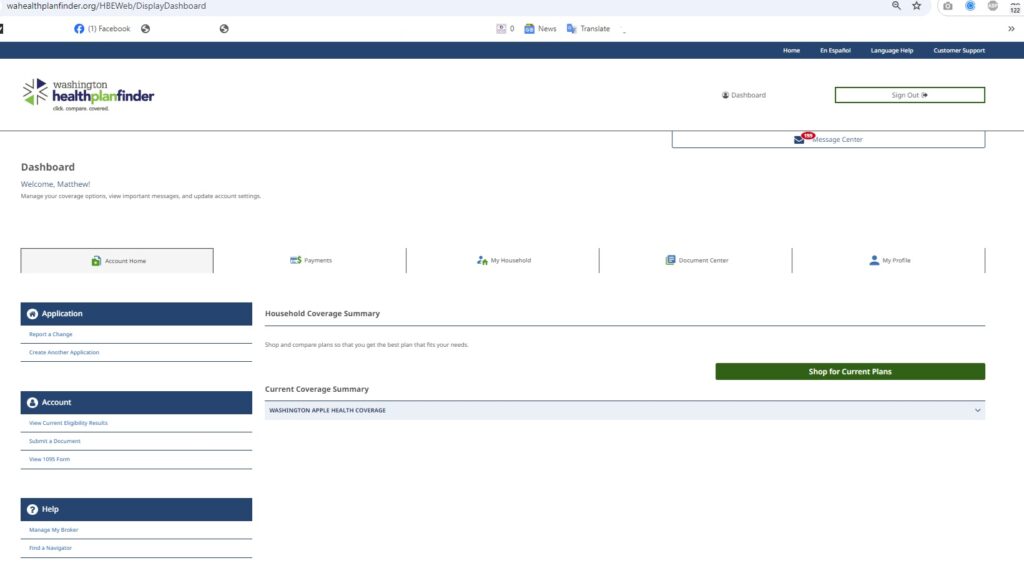

Where can we get our one stop insurance shop in North Central Washington?

At Wenatchee Insurance, Suzie, Matt and Shayla make the Medicare Advantage Open Enrollment period a breeze. They do the research, break down the jargon from the different insurance companies, and find you the best plan for you and your family. No accordion solos, no paperwork nightmares—just great coverage and a sigh of relief.

So, if you’re ready to switch things up (or just make sure you’re on the right plan), pick up the phone and call Suzie. Trust us: your future self will thank you.

Medicare Advantage Open Enrollment ends March 31st. Don’t miss out—call Wenatchee Insurance today!

Topics, Wenatchee, Dental, Medicare, Advantage, Okanogan, Quincy, Grant County,