Fight inflation by changing Medigap plans outside of fall enrollment in Washington

Changing Medicare Medigap plan is not restricted to the specific annual enrollment period like some other parts of Medicare (Plan D), but certain considerations and rules affect when and how you can change your plan:

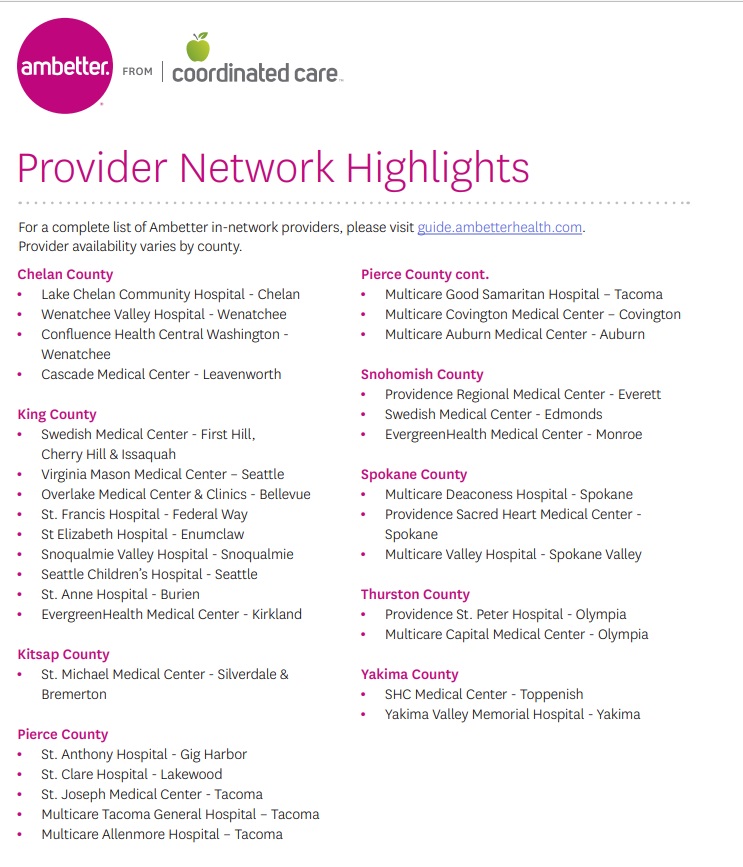

Usually, in spring rates change, if you find your rates inflating then talk to Suzie and see if you can change plans in Washington State. Suzie has in person, video, or phone appointments available in Washington State.

Medigap plans are standardized so price shopping can fight inflation.

Guaranteed Issue Rights: Certain situations, known as “guaranteed issue rights,” allow you to enroll or change Medigap policies without medical underwriting. You have this right during your initial enrollment period. You also have this if you are switching from a Medigap plan to a Medigap plan if you have held coverage for at least three months.

Trial Rights occur when you join a Medicare Advantage Plan when you were first eligible for Medicare Part A at 65, or if you dropped a Medigap policy to join a Medicare Advantage Plan for the first time. These rights allow you to switch to a Medigap policy within the first year of joining. This is a free look that prevents buyer’s remorse.

Important Plan D Note:

Reminder your Medigap plan will not cover prescriptions. Prescription Medication is covered by a Medicare Plan D. These plans are restricted to changes that can be made during the annual enrollment period.

The Annual Enrollment Period runs from October 15 through December 7th. Yes, it is good to review your plan every year during this annual enrollment period, so no surprises occur the following year. It is not required as you will receive documentation of changes from the insurance company, it is however highly recommended.

Set appointment for Oct 15 through Dec 7th.

Dropping a Medigap Policy: Do not just stop paying for your old plan. Take the proper steps with your advisor to have a new plan in place before the old one is dropped. This prevents coverage gaps from occurring.

Before making any changes, it’s a good idea to consult with an assistor who is trained and certified to work with Medicare. The Centers for Medicare & Medicaid Services (CMS) updates the rules every year to protect consumers.

Our Wenatchee Insurance Agency is led by Suzie McColm who has the added background of being a pharmacy technician for twenty-plus years.